Manufacturing output down 6.3% y/y in April

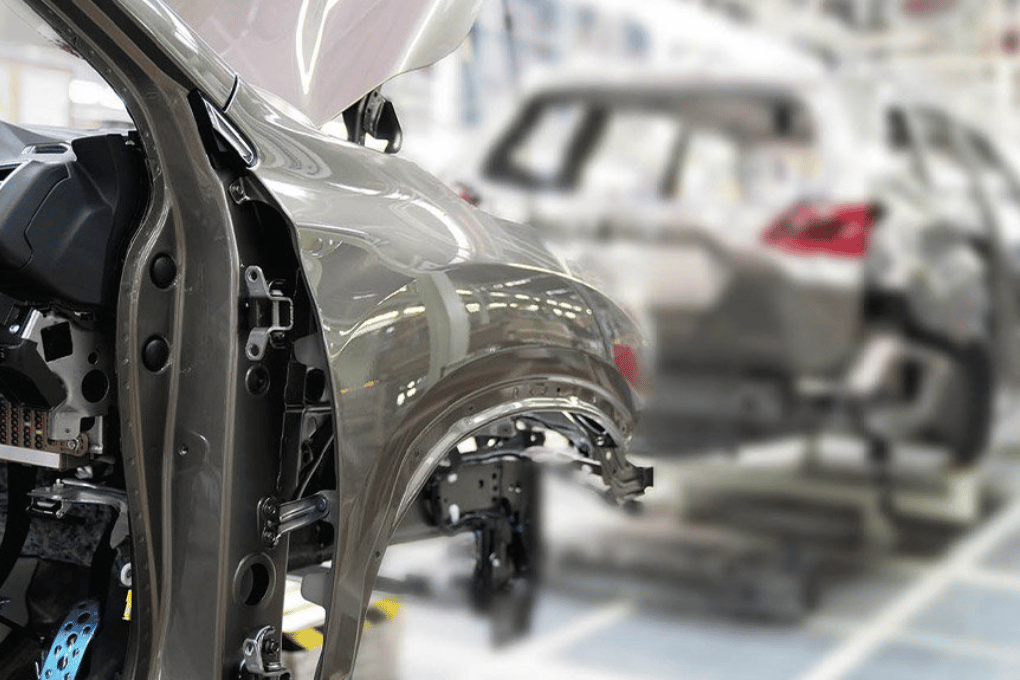

South Africa’s manufacturing sector experienced a sharp decline in April 2025, with production down 6.3% year-on-year. This downturn was driven by significant contractions in key sectors, notably food and beverages; basic iron and steel, nonferrous metal products, metal products and machinery; motor vehicles, parts and accessories and other transport equipment; and petroleum, chemical products, rubber and plastic products.

Despite the year-on-year decline, seasonally adjusted figures showed a 1.9% month-on-month increase in April, following a -2.5% drop in March and no change in February. However, the broader trend remains negative: manufacturing production fell 1.4% in the three months ended April when compared to the preceding three-month period. Seven of the ten manufacturing divisions reported negative growth, with the food and beverages and the furniture and ‘other’ manufacturing divisions being the biggest drags.

Manufacturing sales mirrored this weakness. Seasonally adjusted manufacturing sales declined by 0.7% in April compared to March, following a -0.4% decrease in March and stagnation in February. Over the three-month period ending in April, sales were down 0.3%. The basic iron and steel, nonferrous metal products, metal products and machinery division contributed most to this decline. The only major positive contributor during this period was the motor vehicles, parts and accessories and other transport equipment division.

These figures underscore ongoing volatility in the manufacturing sector, influenced by structural challenges and weak domestic demand. Despite a short-term recovery in monthly output, sustained declines across core divisions suggest broader pressure on industrial performance and sectoral employment prospects.

Implications for Adcorp

Weakness in significant sub-sectors.