Climate Investment Funds approve $2.6bn coal-exit plan for South Africa

A World Bank-linked climate fund has endorsed South Africa’s revised coal transition plan, unlocking up to $2.6 billion in financing to support the country’s shift from coal reliance. The Climate Investment Funds (CIF) approved an update to South Africa’s Accelerating Coal Transition (ACT) investment plan on 11 June 2025, resulting in an immediate $500 million disbursement. This clears the way for up to $2.1 billion more from multilateral institutions such as the World Bank, African Development Bank, and other sources.

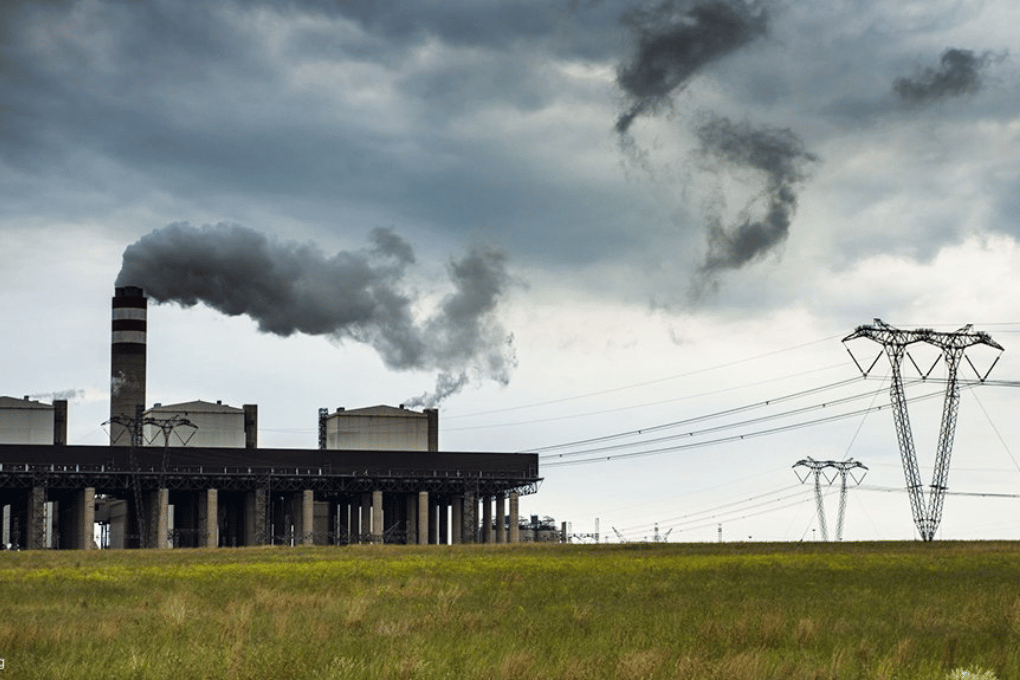

South Africa, which generates roughly 80% of its electricity from coal and has the highest carbon intensity among G20 economies, had delayed the closure of three coal-fired power plants in 2024 to address its ongoing energy crisis. That request temporarily stalled approval of the CIF’s updated support. However, the plan’s recent endorsement allows the country to now submit detailed costings for proposed projects for final funding approval.

This development revives international backing that had been jeopardised by geopolitical tensions and shifting climate policies, especially following the January 2025 inauguration of US President Donald Trump. The US—a major contributor to CIF with $3.8 billion—had previously blocked the South African plan in March and withdrawn from other climate deals affecting Indonesia and Vietnam.

Despite deteriorating US-South Africa relations, including suspended aid and diplomatic boycotts, the CIF’s approval enables the country to proceed with critical transition funding. The plan remains integral to South Africa’s broader decarbonisation strategy and long-term efforts to reduce dependence on coal while modernising its energy infrastructure.

Implications for Adcorp

A sector that will be growing in the medium term, and can inform growth strategy.